Dividend stocks represent one of the most powerful wealth-building strategies available to investors seeking passive income and long-term financial freedom. In fact, unlike traditional investments that rely solely on price appreciation, dividend-paying stocks provide regular cash payments directly to shareholders while simultaneously offering the potential for capital gains. Moreover, this dual-income approach has made dividend investing increasingly popular, with 2025 showing record interest from both novice and experienced investors alike.

The appeal of dividend stocks extends well beyond immediate income generation. Specifically, historical data reveals that dividend-paying stocks have consistently outperformed non-dividend-paying stocks over extended periods. Impressively, dividend growers and initiators achieve an impressive average annual return of 10.2% compared to just 4.3% for dividend non-payers. Furthermore, this performance advantage stems from the financial discipline required to maintain consistent dividend payments, which typically indicates strong cash flow, sustainable business models, and shareholder-friendly management teams. Consequently, investors who focus on quality dividend payers position themselves for superior long-term wealth accumulation.

For investors in Sri Lanka and emerging markets, dividend investing offers an accessible pathway to building wealth through the global stock market. With modern brokerage platforms eliminating barriers to entry, anyone with a few hundred dollars can begin constructing a dividend portfolio that generates passive income for decades to come.

Understanding Dividend Stocks: The Foundation of Passive Income

Dividend stocks are shares in companies that distribute a portion of their profits to shareholders on a regular basis, typically quarterly. When you own dividend stocks, you receive cash payments without needing to sell your shares, creating a true passive income stream. These payments represent your share of the company’s earnings, rewarding you for being a part-owner of the business.

The mechanism is straightforward: profitable companies generate free cash flow after covering operational expenses, debt obligations, and growth investments. Management teams then decide how much to retain for future growth and how much to distribute to shareholders as dividends. Companies committed to dividend payments typically establish a pattern of regular distributions, building trust with income-focused investors.

Why Companies Pay Dividends

Mature, established companies pay dividends for several strategic reasons. First, dividend payments signal financial health and confidence in future earnings, as companies reluctant to cut dividends work diligently to maintain payments even during economic downturns. Second, dividends attract a stable investor base seeking income, which can reduce stock price volatility. Third, for companies in mature industries with limited growth opportunities, returning capital to shareholders represents the most efficient use of profits.

Types of Dividend Investors

The dividend investing community encompasses diverse strategies. Income investors prioritize current cash flow, seeking stocks with yields above 4-5% to support living expenses or supplement retirement income. Growth investors focus on companies with lower current yields but strong dividend growth rates, targeting annual increases of 5-10% or more. Value investors combine both approaches, seeking undervalued dividend payers trading below intrinsic value.

The Compelling Benefits of Dividend Investing

Reliable Passive Income Stream

The primary advantage of dividend stocks is the predictable cash flow they generate. Unlike capital gains that require selling shares, dividends provide regular payments regardless of market conditions. A well-constructed dividend portfolio yielding 4% annually on a $100,000 investment delivers $4,000 in passive income without touching your principal. This income stream can cover expenses, fund new investments, or simply provide financial peace of mind.

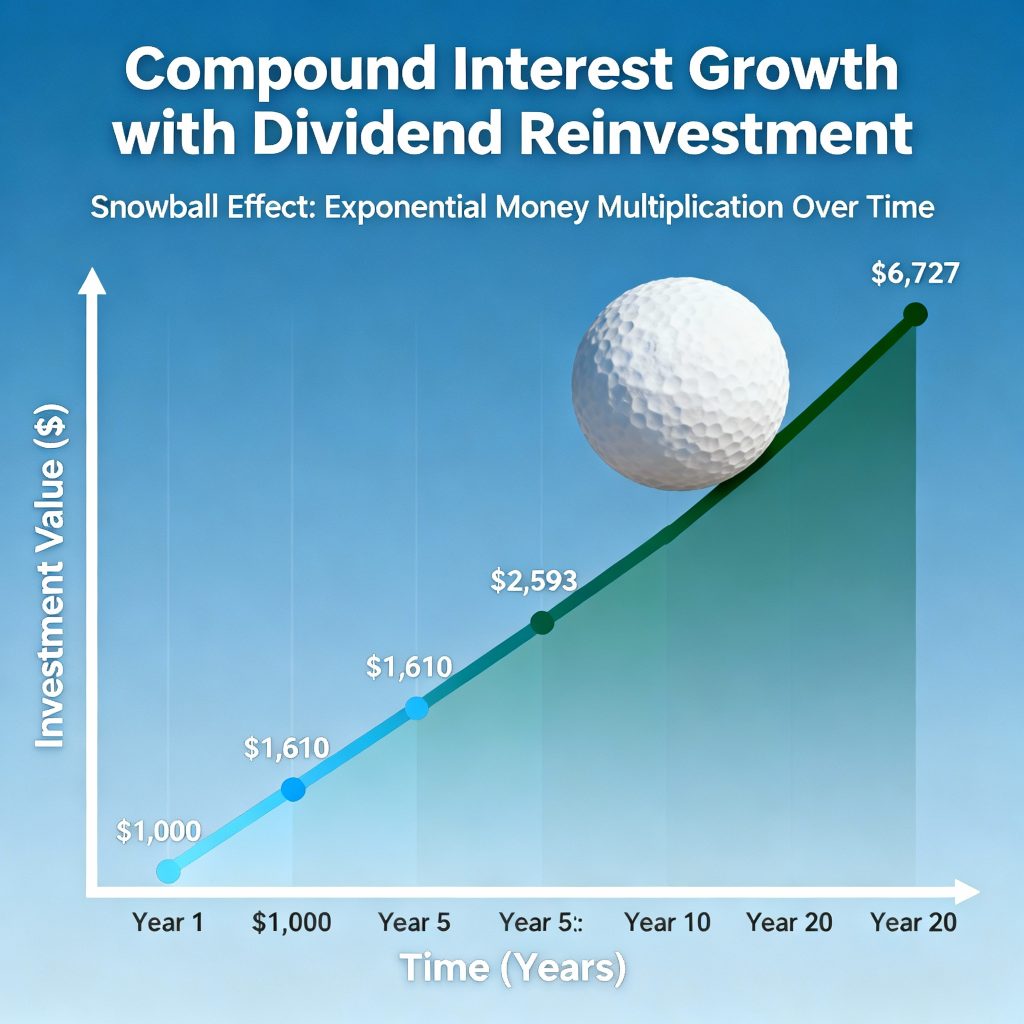

Compounding Through Reinvestment

Dividend reinvestment plans (DRIPs) harness the exponential power of compound interest. By automatically using dividend payments to purchase additional shares, investors accumulate more shares that themselves pay dividends, creating a snowball effect. Over 20-30 years, this compounding can dramatically amplify returns. Research shows that reinvested dividends historically account for approximately 31% of the S&P 500’s total return since 1926.

Lower Volatility and Downside Protection

Dividend-paying stocks typically exhibit less price volatility than growth stocks or non-dividend payers. Importantly, the regular income cushions against market downturns, as investors receive returns even when share prices decline. To illustrate this point, during the 2020 market crash, many dividend aristocrats—companies with 25+ years of consecutive dividend increases—maintained their payments and recovered faster than the broader market. In fact, this defensive characteristic makes dividend stocks particularly valuable during economic uncertainty and market volatility.

Moreover, the income stability provided by dividends creates a psychological buffer against panic selling during downturns. Additionally, when share prices decline, dividend yields actually increase, creating attractive entry points for new investors. Consequently, this combination of income support and reduced volatility makes dividend stocks an ideal core holding for risk-averse investors seeking both stability and growth.

Inflation Hedge Through Growing Dividends

Unlike fixed-income investments, dividend growth stocks provide protection against inflation. Companies that consistently raise dividends typically increase payments at rates exceeding inflation, preserving and enhancing purchasing power over time. A stock yielding 3% today with 7% annual dividend growth will yield over 10% on your original cost basis within 15 years.

Tax Advantages

Qualified dividends receive preferential tax treatment in many jurisdictions, taxed at long-term capital gains rates (0%, 15%, or 20%) rather than ordinary income rates that can reach 37%. This tax efficiency significantly enhances after-tax returns, particularly for investors in higher tax brackets.

Building Your Dividend Stock Strategy: Core Principles

Dividend Aristocrats: The Gold Standard

Dividend aristocrats represent the elite class of dividend stocks, comprising S&P 500 companies that have increased dividends for at least 25 consecutive years. As of 2025, 69 companies hold this distinguished status, including household names like Johnson & Johnson, Coca-Cola, Procter & Gamble, and Walmart. These companies demonstrate exceptional financial discipline, resilient business models, and unwavering commitment to shareholders.

The dividend aristocrats list changes annually as companies either join by reaching the 25-year milestone or exit due to dividend cuts or S&P 500 removal. Recent additions in 2025 include FactSet Research Systems, Eversource Energy, and Erie Indemnity. The aristocrats have historically outperformed the broader market while providing lower volatility, making them ideal core holdings for dividend portfolios.

Dividend Growth vs. High Yield

A fundamental choice faces dividend investors: pursue high current yields or focus on dividend growth potential. High-yield stocks typically offer immediate returns of 5-10%+ but often carry elevated risks including high payout ratios, elevated debt levels, and limited growth prospects. Companies in utilities, telecommunications, and real estate investment trusts (REITs) commonly fall into this category.

Dividend growth stocks, conversely, may yield only 2-3% initially but increase payments at substantial rates annually. Research demonstrates that dividend growth stocks deliver superior long-term total returns, with the S&P 500 Dividend Aristocrats Index returning 12.4% annually since 2011 compared to 7.7% for the equal-weighted S&P 500. The power of dividend growth becomes evident over time as your yield on cost—the dividend yield based on your original purchase price—expands dramatically.

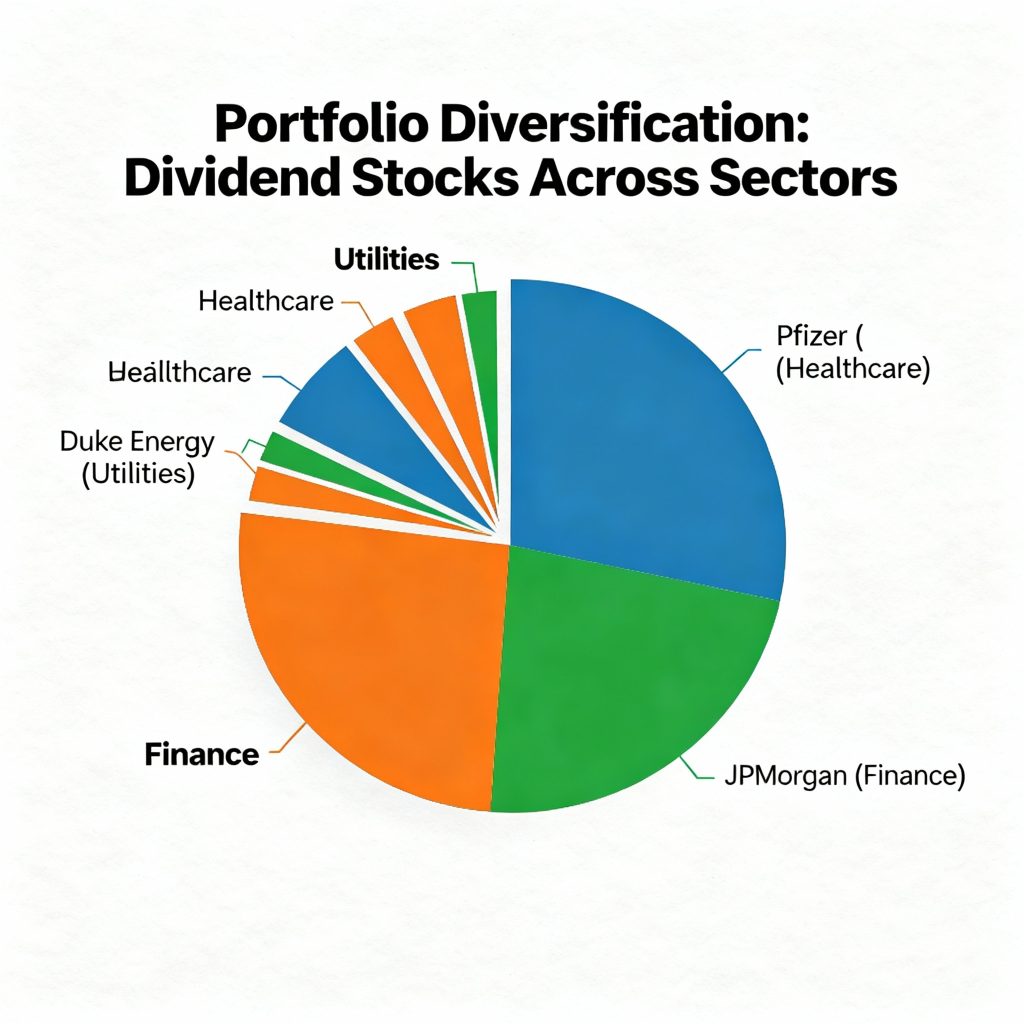

Sector Diversification

Constructing a balanced dividend portfolio requires diversification across sectors with different economic characteristics. Consumer staples companies like Procter & Gamble and Coca-Cola provide stability through recession-resistant products. Healthcare stocks including AbbVie and Johnson & Johnson offer demographic tailwinds from aging populations. Financial sector dividend payers like JPMorgan Chase benefit from rising interest rates. Utilities such as Dominion Energy and Eversource deliver predictable income through regulated monopolies. Industrial dividend stocks including Caterpillar and Emerson Electric provide economic growth exposure.

This sector mix ensures your portfolio isn’t overly exposed to industry-specific risks or economic cycles. During the 2020 pandemic, healthcare and consumer staples dividend stocks maintained payments while energy and financial companies faced challenges.

Critical Metrics for Evaluating Dividend Stocks

Dividend Yield Calculation

Dividend yield represents the annual dividend payment as a percentage of the stock price. The formula is straightforward: Dividend Yield = Annual Dividends Per Share ÷ Current Stock Price. For example, a stock trading at $100 with $4 in annual dividends yields 4%. While attractive, high yields above 6-7% warrant careful scrutiny as they may signal underlying problems or unsustainable payouts.

Payout Ratio: Sustainability Indicator

The payout ratio measures what percentage of earnings a company distributes as dividends, calculated by dividing total dividends by net income (or dividends per share by earnings per share). A payout ratio of 60% means the company pays 60% of earnings to shareholders and retains 40% for growth, debt reduction, or reserves.

Healthy payout ratios typically fall between 30-70% depending on the industry. Ratios below 50% suggest strong dividend safety with room for future increases. Ratios above 80% raise concerns about sustainability, as companies have minimal cushion if earnings decline. REITs and utilities often maintain higher ratios (70-80%) due to regulatory requirements and stable cash flows. Payout ratios exceeding 100% are red flags indicating companies pay more in dividends than they earn, an unsustainable practice.

Dividend Coverage Ratio

The dividend coverage ratio, calculated by dividing earnings per share by dividends per share, indicates how many times earnings cover dividend payments. A ratio of 2.0 means the company earns twice what it pays in dividends, providing substantial safety margin. Ratios below 1.5 suggest potential vulnerability, while ratios above 2.5 indicate strong dividend security with growth potential.

Free Cash Flow Analysis

Free cash flow to equity (FCFE) represents the actual cash available for dividend payments after capital expenditures and debt obligations. Companies should ideally fund dividends entirely from free cash flow rather than borrowing or depleting reserves. Comparing dividend payments to free cash flow reveals whether dividends are truly sustainable. Companies paying 70% of free cash flow as dividends demonstrate healthier fundamentals than those paying 100%+ of free cash flow.

Debt Levels and Balance Sheet Strength

Excessive debt competes with dividends for limited cash resources. During financial stress, companies must prioritize debt payments over dividends, making high-debt companies riskier dividend investments. Evaluate debt levels using the debt-to-equity ratio and net debt to EBITDA ratio. Companies with investment-grade credit ratings (BBB- or higher) generally maintain safer dividend profiles than those with speculative-grade ratings.

Dividend Growth History

A company’s dividend growth track record reveals management’s commitment to shareholders and underlying business strength. Seek companies demonstrating consistent dividend increases over 5-10+ years, with annual growth rates of 5-10%. Companies that maintained or increased dividends during the 2008 financial crisis and 2020 pandemic demonstrate exceptional resilience.

The Power of Dividend Reinvestment Plans (DRIPs)

Dividend reinvestment plans automate the process of using dividend payments to purchase additional shares, typically without commission fees. This automation ensures every dividend dollar immediately works for you, buying more shares that generate more dividends in a virtuous cycle.

How DRIPs Work

When enrolled in a DRIP, instead of receiving cash dividends, the brokerage automatically purchases additional shares (including fractional shares) on the dividend payment date. For example, if you own 100 shares of a stock paying $1 per share quarterly dividends and the stock price is $50, your $100 dividend payment buys 2 additional shares. Next quarter, you’ll own 102 shares generating $102 in dividends, which purchases 2.04 more shares, and so on.

DRIP Advantages

DRIPs offer multiple benefits for long-term investors. First, commission-free purchases maximize every dollar’s impact. Second, automatic reinvestment implements dollar-cost averaging, buying more shares when prices are low and fewer when prices are high. Third, the compounding effect dramatically accelerates wealth accumulation over decades. Fourth, the hands-off approach eliminates emotional decisions about when to invest.

DRIP Considerations

While powerful, DRIPs require awareness of tax implications. Reinvested dividends remain taxable income in non-retirement accounts, requiring you to pay taxes despite not receiving cash. This can create cash flow challenges if your dividend income is substantial. Additionally, each reinvestment creates a separate tax lot with its own cost basis, potentially complicating tax reporting when selling shares.

For tax-advantaged accounts like IRAs, DRIPs are ideal as taxes are deferred until withdrawal. In taxable accounts, carefully consider whether you need the cash income or prefer compounding growth.

Common Dividend Investing Risks and Pitfalls

The Dividend Trap: Chasing Unsustainable Yields

High dividend yields can seduce investors into value traps where yields are elevated because share prices have collapsed due to fundamental problems. In reality, a stock yielding 8-10% may reflect market concerns about dividend sustainability rather than generous management. Notably, companies in financial distress often maintain dividends longer than prudent, eventually cutting payments and causing share prices to plummet further.

Warning signs of dividend traps are critical to understand. For instance, payout ratios exceeding 100%, declining revenues or earnings, deteriorating balance sheets with rising debt, and yields significantly exceeding industry peers all indicate potential problems. Consider, for example, Walgreens Boots Alliance, which exemplified this risk in 2024 by cutting its dividend nearly in half after years of struggling operations despite a high historical yield. Clearly, what appears to be an attractive dividend opportunity can quickly turn into a devastating loss.

Therefore, avoiding dividend traps requires rigorous analysis and skepticism toward yields that seem too good to be true. As a general rule, investigate any stock yielding significantly above its industry peers. In conclusion, the most successful dividend investors recognize that sustainable income beats high current yields every time.

Dividend Cut Risk

Companies can reduce or eliminate dividends at any time without legal obligation to shareholders. Dividend cuts typically devastate stock prices as income-focused investors flee, creating double losses from both reduced income and capital depreciation. The 2020 pandemic witnessed numerous dividend cuts across energy, retail, and hospitality sectors as cash flows evaporated.

Mitigate dividend cut risk by focusing on companies with strong balance sheets, conservative payout ratios below 70%, diversified revenue streams, and histories of maintaining dividends through previous recessions. Dividend aristocrats with 25+ years of increases demonstrate proven ability to sustain payments through multiple economic cycles.

Interest Rate Risk

Dividend stocks compete with bonds and fixed-income securities for income-seeking investors. When interest rates rise, bonds become more attractive, potentially causing dividend stock prices to decline as investors reallocate capital. This inverse relationship between interest rates and dividend stock valuations particularly affects high-yielding utilities and REITs.

However, rising rates don’t uniformly harm all dividend stocks. Financial sector companies like banks often benefit from higher rates through improved net interest margins. Companies with strong pricing power can pass inflation to customers, supporting earnings and dividend growth despite rate pressures.

Sector Concentration Risk

Over-concentrating dividend holdings in specific sectors creates vulnerability to industry-specific shocks. A portfolio heavily weighted toward energy dividend stocks suffered during 2020’s oil price collapse, while technology-focused portfolios lacked dividend income during the sector’s growth phase. Maintain exposure across consumer staples, healthcare, financials, industrials, utilities, and other sectors to balance risks.

Tax Inefficiency in Wrong Accounts

Holding dividend stocks in taxable accounts generates annual tax obligations even when reinvesting dividends. For investors in high tax brackets, this can significantly reduce after-tax returns. Conversely, holding dividend stocks in tax-advantaged retirement accounts like IRAs wastes the tax benefits of qualified dividend rates. Optimal tax management places dividend stocks in taxable accounts for preferential rates and bonds or REITs in retirement accounts where ordinary income isn’t taxed until withdrawal.

Inflation Risk for Low-Growth Dividends

Companies paying high current yields but minimal dividend growth may fail to keep pace with inflation, eroding real purchasing power over time. A 5% yielding stock with no dividend growth loses real value annually when inflation exceeds 5%. Conversely, a 3% yielding stock growing dividends 8% annually overtakes the high-yielder within years while providing inflation protection.

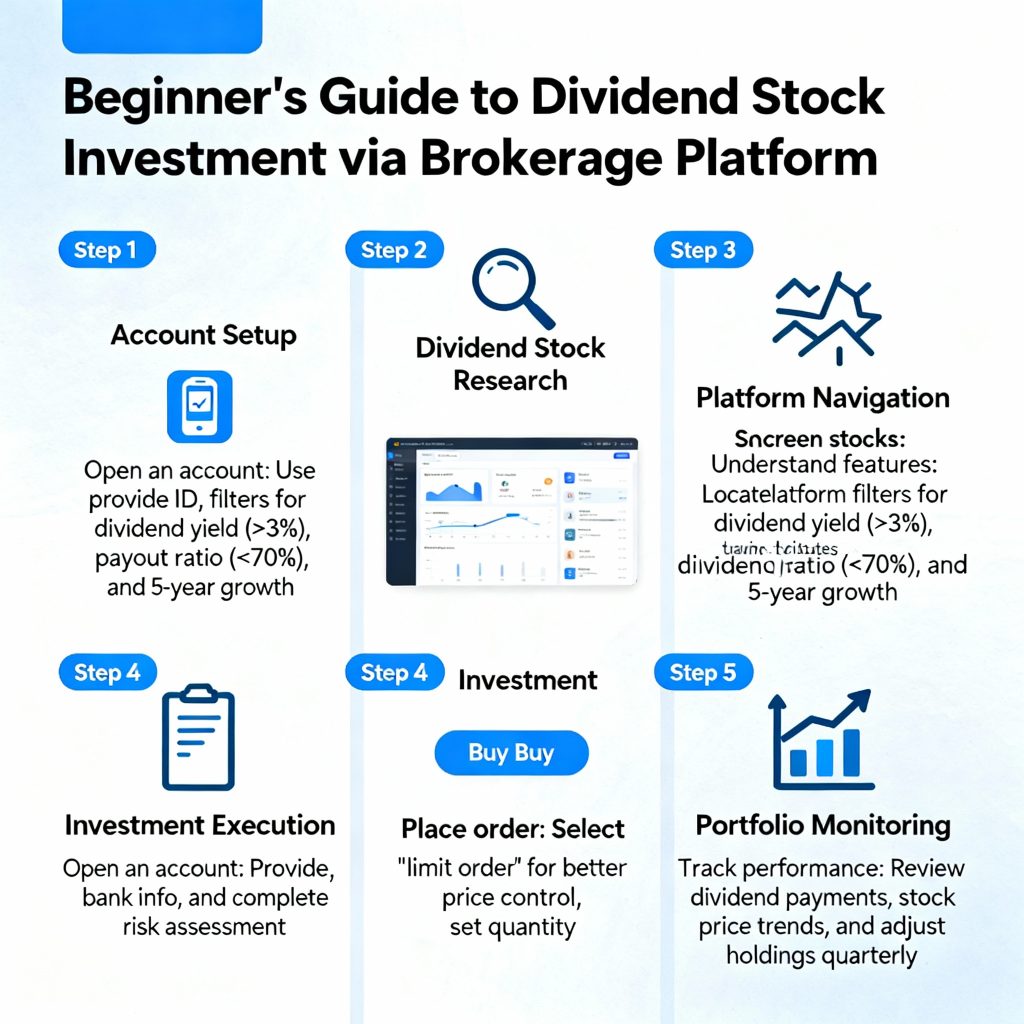

Step-by-Step Guide to Start Dividend Investing

Step 1: Define Your Investment Goals

Clarify whether you prioritize current income needs or long-term wealth accumulation. Income-focused retirees may prefer higher-yielding stocks and minimal reinvestment. Younger investors building wealth should emphasize dividend growth and aggressive reinvestment through DRIPs. Your time horizon, risk tolerance, and income requirements fundamentally shape portfolio construction.

Step 2: Choose the Right Brokerage Platform

Select a commission-free brokerage platform supporting dividend reinvestment plans. Popular options include Fidelity, Charles Schwab, Vanguard, and TD Ameritrade, all offering zero-commission stock trades and robust DRIP programs. For investors in Sri Lanka and international markets, platforms like Interactive Brokers provide global stock access with competitive fees. Evaluate platforms based on commission structure, available investments, research tools, dividend reinvestment options, and user interface.

Step 3: Screen for Quality Dividend Stocks

Implement systematic screening criteria to identify high-quality dividend investments:

- Dividend yield: 2-5% to balance current income with sustainability

- Payout ratio: Below 70% for safety margin

- Market capitalization: Above $2-10 billion for stability

- Dividend growth rate: 5%+ annually over 5+ years

- Return on equity: Above industry average indicating efficient profit generation

- Debt-to-equity ratio: Below industry average for financial strength

- Credit rating: Investment-grade (BBB- or better) for reduced default risk

- Free cash flow: Positive and growing to support dividend payments

Stock screener tools on brokerage platforms and specialized sites like TIKR enable filtering based on these criteria.

Step 4: Research Individual Companies

Beyond quantitative metrics, conduct qualitative research into potential investments. Analyze the company’s business model, competitive advantages, industry position, and growth prospects. Read recent earnings reports, assess management’s commitment to dividends, and understand headwinds or tailwinds facing the business. Diversify across 15-30 individual stocks or consider dividend-focused ETFs for instant diversification.

Step 5: Build a Diversified Portfolio

Allocate capital across sectors and companies to minimize concentration risk. A balanced dividend portfolio might include:

- Consumer Staples (20%): Procter & Gamble, Coca-Cola, Pepsi

- Healthcare (20%): Johnson & Johnson, AbbVie, Medtronic

- Financials (15%): JPMorgan Chase, Bank of America

- Industrials (15%): Caterpillar, Emerson Electric, 3M

- Utilities (10%): NextEra Energy, Dominion Energy

- Consumer Discretionary (10%): McDonald’s, Lowe’s, Target

- Information Technology (10%): Microsoft, Apple, Texas Instruments

Adjust allocations based on your risk profile, income needs, and market valuations.

Step 6: Enable Dividend Reinvestment

Contact your brokerage to activate DRIP for your dividend stocks, ensuring automatic reinvestment of all dividend payments. Most platforms offer account-wide DRIP enrollment or per-security selection. For retirement accounts like IRAs, always enable DRIP to maximize tax-advantaged compounding. In taxable accounts, evaluate whether you need dividend income for expenses or prefer growth through reinvestment.

Step 7: Monitor and Rebalance Periodically

Review your dividend portfolio quarterly to ensure companies maintain financial health and dividend safety. Watch for deteriorating metrics like rising payout ratios, declining free cash flow, or increasing debt levels. Rebalance annually by trimming positions that have grown oversized and adding to underweighted sectors or attractive new opportunities. However, avoid excessive trading that triggers taxes and commissions—dividend investing rewards patience.

Best Dividend Investment Vehicles for Different Investors

Individual Dividend Stocks

Direct stock ownership provides maximum control and customization for hands-on investors. Build a personalized portfolio aligned precisely with your income needs, risk tolerance, and sector preferences. Individual stocks offer potential for higher returns than funds but require more research, monitoring, and diversification efforts. Suitable for investors with $10,000+ to allocate, enabling 15-20 position portfolio construction.

Dividend ETFs and Index Funds

Dividend-focused ETFs offer instant diversification across dozens or hundreds of dividend stocks with single purchases. Popular options include:

- SCHD (Schwab U.S. Dividend Equity ETF): Tracks 100 high-quality dividend stocks with strong fundamentals, yielding approximately 3.5%

- VYM (Vanguard High Dividend Yield ETF): Provides exposure to 500+ dividend payers across sectors

- NOBL (ProShares S&P 500 Dividend Aristocrats ETF): Invests exclusively in dividend aristocrats

- DURA (VanEck Durable High Dividend ETF): Focuses on high yields with quality screens

ETFs charge minimal expense ratios (0.03-0.35% annually) and suit beginners or investors with limited capital. Drawbacks include less control over specific holdings and mandatory taxable distributions even in down years.

Dividend Mutual Funds

Actively managed dividend mutual funds employ professional managers selecting and monitoring dividend stocks. While potentially offering expertise and research, mutual funds typically charge higher fees (0.50-1.50% annually) that erode returns compared to low-cost index ETFs. Few active managers consistently outperform dividend indices after fees.

Tax-Efficient Dividend Investing Strategies

Understanding Qualified vs. Ordinary Dividends

Tax treatment dramatically impacts after-tax dividend returns. First and foremost, qualified dividends receive favorable long-term capital gains tax rates (0%, 15%, or 20%) if you hold the underlying stock for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date. In contrast, ordinary (non-qualified) dividends are taxed as regular income at rates up to 37%, significantly reducing returns for high earners.

Most importantly, most dividends from U.S. corporations and qualifying foreign companies meet qualified status if you satisfy holding period requirements. However, REITs, master limited partnerships (MLPs), and certain foreign dividends typically pay non-qualified dividends subject to ordinary income rates. Therefore, understanding which dividends qualify for preferential tax treatment is essential to maximizing your after-tax returns.

Account Placement Strategy

Strategic account placement optimizes tax efficiency. Hold dividend stocks in taxable brokerage accounts to benefit from qualified dividend rates. Reserve tax-deferred accounts (Traditional IRA, 401k) for bonds, REITs, and other investments generating ordinary income. Roth IRAs provide ultimate flexibility since all distributions are tax-free in retirement.

Tax Loss Harvesting

In taxable accounts, offset dividend income by harvesting capital losses from underperforming positions. Selling losing positions generates realized losses that offset dividend income and capital gains, reducing current tax liability. Immediately reinvest proceeds in similar but not identical securities to maintain market exposure while capturing tax benefits.

Holding Period Discipline

Ensure you satisfy the 61-day holding requirement for qualified dividend treatment. Frequent trading around ex-dividend dates may disqualify dividends from preferential rates, converting them to ordinary income. This particularly impacts options strategies like covered calls that reduce holding periods.

Dividend Investing for Different Life Stages

Young Investors (20s-30s)

Young investors with decades until retirement should prioritize dividend growth over current income. Specifically, focus on dividend aristocrats and companies with 5-10%+ annual dividend growth rates even if current yields are modest at 2-3%. Moreover, aggressively reinvest all dividends through DRIPs to maximize compounding. As a result, a $10,000 investment at age 25 in dividend growth stocks yielding 3% initially with 8% annual dividend growth and full reinvestment can grow to $300,000+ by age 65.

Furthermore, this exponential growth demonstrates why time is your greatest asset when building wealth through dividends. Additionally, young investors should allocate 80-100% of portfolio to dividend growth stocks across all sectors. In fact, maintaining 15-25 individual positions or 100% allocation to dividend growth ETFs like SCHD maximizes diversification. Finally, prioritize tax-advantaged retirement accounts to defer taxes on reinvested dividends.

Allocate 80-100% of portfolio to dividend growth stocks across all sectors. Maintain 15-25 individual positions or 100% allocation to dividend growth ETFs like SCHD. Prioritize tax-advantaged retirement accounts to defer taxes on reinvested dividends.

Mid-Career Investors (40s-50s)

Mid-career investors should balance dividend growth with increasing current income. Shift gradually from pure growth to blended strategies incorporating higher-yielding positions. Target portfolio yield of 3-4% with dividend growth rates of 5-7% annually. Begin utilizing dividend income for financial goals like college savings, debt reduction, or accelerated retirement contributions.

Maintain 70% allocation to dividend growth stocks and 30% to higher-yielding positions in utilities, REITs, and consumer staples. Rebalance annually to lock in gains from appreciated positions. Continue maximizing retirement account contributions and DRIP reinvestment.

Pre-Retirement Investors (55-65)

As retirement approaches, gradually increase portfolio yield while maintaining quality. Target 4-5% yield with modest 3-5% dividend growth to balance current income with inflation protection. Begin modeling how dividend income will supplement retirement income needs.

Shift allocation to 50% dividend growth stocks and 50% higher-yielding positions. Reduce concentration in cyclical sectors like energy and materials while increasing defensive sectors like utilities, healthcare, and consumer staples. Build cash reserves covering 1-2 years of expenses to avoid selling stocks during market downturns.

Retirees (65+)

Retirees prioritize sustainable income to cover living expenses. Target portfolio yields of 4-6% from high-quality dividend payers with strong balance sheets and recession-resistant business models. Maintain some dividend growth exposure (30-40% of portfolio) for inflation protection.

Partially or fully disable DRIPs to receive cash dividends for spending. Maintain 60% allocation to dividend stocks and 40% to bonds/cash for stability and liquidity. Consider dividend-focused funds like SCHD or sector-specific ETFs in utilities and consumer staples for simplified management.

Building Wealth Through Dividend Investing: Real-World Examples

The Power of Long-Term Dividend Growth

Consider two hypothetical investments made in March 2008: Verizon Communications (high yield strategy) versus Visa (dividend growth strategy). Verizon initially offered 5.6% yield compared to Visa’s modest 0.2% yield. However, Visa consistently grew dividends at double-digit rates annually while Verizon’s increases were minimal.

By 2020, Visa’s yield on cost exceeded Verizon’s at 7.8% versus 7.2%. By 2023, Visa’s yield on cost reached 12% compared to Verizon’s 7.8%, demonstrating how dividend growth overwhelms initial yield differences over time. Combined with superior price appreciation, Visa’s total return dramatically outperformed Verizon’s high yield.

Dividend Aristocrats Performance

The S&P 500 Dividend Aristocrats Index has delivered average annual returns of 12.4% since inception in 2011, substantially outperforming the 7.7% return of the equal-weighted S&P 500. This outperformance stems from the financial discipline and resilient business models required to increase dividends for 25+ consecutive years.

During market downturns, dividend aristocrats typically decline less than the broader market due to their defensive characteristics and income support. In subsequent recoveries, aristocrats participate fully in rebounds while continuing to pay rising dividends.

Advanced Dividend Investing Concepts

Dividend Capture Strategy

Dividend capture involves purchasing stocks shortly before ex-dividend dates, collecting the dividend, then selling shortly after. While theoretically possible, this strategy faces practical challenges. Stock prices typically decline by approximately the dividend amount on ex-dividend dates, offsetting dividend gains. Additionally, frequent trading generates commissions, bid-ask spreads, and tax inefficiencies as dividends become non-qualified.

For most investors, dividend capture proves less profitable than buy-and-hold dividend growth strategies.

Covered Call Writing on Dividend Stocks

Writing covered calls on dividend stock holdings generates additional income beyond dividends. However, covered calls can disqualify dividends from qualified treatment if the calls are too deep in-the-money, converting them to ordinary income taxed at higher rates. Additionally, called-away positions require repurchasing shares at higher prices or missing future dividend growth.

International Dividend Stocks

Expanding beyond domestic markets, international dividend stocks offer diversification and potentially higher yields. However, foreign dividends often face withholding taxes (10-30%) imposed by source countries. U.S. investors can claim foreign tax credits in taxable accounts but not in retirement accounts, reducing after-tax returns. Currency fluctuations add additional risk and complexity to international dividend investing.

Creating Your Dividend Investing Action Plan

Successful dividend investing requires a systematic, disciplined approach executed consistently over decades. Begin with clear financial goals, realistic income expectations, and appropriate risk tolerance assessment. Invest regularly regardless of market conditions to benefit from dollar-cost averaging. Maintain unwavering focus on quality over yield, prioritizing sustainable dividends from financially healthy companies.

Reinvest dividends during accumulation years to harness compounding’s exponential power. Monitor holdings quarterly but avoid reactive selling during market volatility. Gradually transition from dividend growth to income focus as retirement approaches. Most importantly, maintain patience—dividend investing rewards those who think in decades, not days.

With proper research, diversification, and long-term perspective, dividend stocks can transform your financial future, generating the passive income that supports your lifestyle, achieves your goals, and builds lasting wealth for you and future generations.