The cryptocurrency market continues to evolve as a dynamic wealth-creation ecosystem, offering unprecedented opportunities for investors seeking substantial returns. With the total cryptocurrency market capitalization hovering near $4 trillion and showing resilience through market cycles, identifying the best cryptocurrencies to buy for profit has become both an art and a science. This comprehensive guide explores the most promising digital assets for 2025, analyzing established giants, emerging DeFi protocols, innovative Layer 2 solutions, and high-potential altcoins that could deliver exceptional returns.

Understanding the 2025 Cryptocurrency Landscape

The cryptocurrency market has matured significantly since Bitcoin’s inception, yet it retains the explosive growth potential that attracts investors worldwide. As of October 2025, the market demonstrates remarkable strength with 95 of the top 100 cryptocurrencies showing gains, and total trading volume exceeding $246 billion. This bullish momentum reflects several converging factors: institutional adoption accelerating through Bitcoin and Ethereum ETFs, regulatory clarity emerging in major markets, and technological innovations solving fundamental blockchain challenges.

Investment strategies that worked in previous cycles may not translate directly to today’s market. The 2025 landscape rewards investors who understand not just individual cryptocurrencies but entire ecosystems—DeFi protocols, Layer 2 solutions, real-world asset tokenization, and cross-chain interoperability. Success requires balancing exposure to established cryptocurrencies that provide portfolio stability with strategic allocations to high-growth opportunities that could deliver exponential returns.

Market analysis reveals that while Bitcoin maintains its position as the digital gold standard, alternative cryptocurrencies (altcoins) are capturing increasing market share and delivering impressive performance. The anticipated “altseason”—periods when Bitcoin’s dominance decreases and capital flows into altcoins—creates conditions for substantial gains across diverse cryptocurrency sectors.

Ethereum and Bitcoin: The Cornerstone Investments

Bitcoin (BTC): Digital Gold for the Modern Era

Bitcoin remains the undisputed leader of the cryptocurrency market, with a market capitalization exceeding $2.2 trillion and a current price around $111,000-$115,000. As the first and most widely adopted cryptocurrency, Bitcoin has established itself as a store of value, with institutional investors increasingly viewing it as “digital gold” and a hedge against inflation.

Several factors make Bitcoin an essential component of any cryptocurrency investment portfolio for 2025. The approval of Bitcoin Spot ETFs in 2024 marked a watershed moment, providing traditional investors with regulated, accessible exposure to Bitcoin. Major financial institutions like BlackRock now offer Bitcoin products, validating the asset class and channeling billions in institutional capital into the market.

Bitcoin’s scarcity—with a fixed supply of 21 million coins—creates inherent value as demand continues growing. The halving events that occur approximately every four years reduce new supply entering circulation, historically triggering significant price appreciation. Mathematical models suggest Bitcoin could reach $133,000 to $178,000 in 2025, with more optimistic predictions extending to $750,000 by 2026.

Beyond price speculation, Bitcoin has evolved into critical financial infrastructure. Its decentralized nature provides censorship resistance and permissionless transactions, making it valuable in regions with unstable currencies or restrictive financial systems. For investors seeking stability within the cryptocurrency market’s volatility, Bitcoin offers the most established track record and largest liquidity.

Ethereum (ETH): The Smart Contract Powerhouse

Ethereum stands as the backbone of decentralized applications, smart contracts, and the entire DeFi ecosystem, with a market capitalization exceeding $483 billion and trading around $4,000-$4,150. While Bitcoin excels as digital gold, Ethereum functions as a decentralized global computer enabling programmable money and innovative financial applications.

Ethereum’s technological evolution significantly enhances its investment appeal. The successful transition to Proof-of-Stake consensus through “The Merge” dramatically reduced energy consumption by over 99%, addressing environmental concerns while enabling staking for passive income. The implementation of EIP-4844 (“Proto-Danksharding”) and the Pectra upgrade in May 2025 substantially reduced gas fees and increased transaction speeds, making Ethereum more accessible and efficient.

The platform’s dominance in smart contract functionality makes it indispensable to numerous cryptocurrency sectors. Ethereum hosts the majority of DeFi protocols, NFT marketplaces, decentralized exchanges, and tokenization projects. This network effect creates a virtuous cycle where more developers building on Ethereum attracts more users, which in turn attracts more developers.

Institutional adoption is accelerating, with major investment firms eyeing Ethereum’s infrastructure for tokenizing traditional assets like stocks, bonds, and real estate. Ethereum ETFs are gaining traction, providing mainstream investment vehicles for institutional and retail investors. The network’s position at the intersection of cryptocurrency, DeFi, and Web3 innovation makes it a cornerstone investment for 2025.

Analysts project Ethereum could experience significant appreciation as Layer 2 solutions built on top of Ethereum mature, solving scalability challenges while maintaining the security and decentralization of the base layer. For investors seeking exposure to the broader cryptocurrency ecosystem beyond Bitcoin, Ethereum provides the most comprehensive and battle-tested platform.

DeFi Tokens: The Future of Finance

Decentralized Finance (DeFi) represents one of the most transformative use cases for blockchain technology, with protocols collectively managing over $150 billion in total value locked (TVL). DeFi eliminates traditional financial intermediaries, enabling peer-to-peer lending, borrowing, trading, and yield generation through transparent, programmable smart contracts. For investors seeking the best cryptocurrencies to buy for profit, DeFi tokens offer exposure to this revolutionary financial infrastructure.

Lido (LDO): Liquid Staking Leader

Lido dominates the liquid staking sector with approximately $30 billion in TVL, making it the largest DeFi protocol. Liquid staking solves a critical problem: traditional staking locks assets, preventing their use elsewhere. Lido allows users to stake Ethereum and receive stETH (staked ETH) tokens that represent their stake plus accrued rewards, while remaining liquid and usable across DeFi protocols.

This innovation enables capital efficiency previously impossible in staking. Users earn staking rewards (approximately 2.48-6% APY) while simultaneously using their stETH as collateral for loans, providing liquidity to DEXs, or participating in yield farming strategies. As Ethereum’s Proof-of-Stake ecosystem matures, Lido’s first-mover advantage and massive liquidity position it for continued growth.

Aave (AAVE): Lending Protocol Pioneer

Aave ranks among the most established DeFi lending platforms, with approximately $15 billion in TVL and multi-chain support across Ethereum, Polygon, Avalanche, and other networks. The protocol enables users to deposit cryptocurrencies to earn interest or borrow against collateral without traditional credit checks or intermediaries.

Aave’s innovation extends beyond basic lending. The platform pioneered flash loans—uncollateralized loans that must be borrowed and repaid within a single transaction, enabling arbitrage and other advanced strategies. The protocol’s governance token (AAVE) provides voting rights on protocol parameters and receives value from protocol fees, aligning token holder interests with platform success.

With institutional DeFi adoption increasing and traditional finance exploring blockchain integration, Aave’s established reputation, security track record, and continuous innovation position it as a blue-chip DeFi investment for 2025.

Uniswap (UNI): Decentralized Exchange Giant

Uniswap revolutionized cryptocurrency trading through its automated market maker (AMM) model, enabling permissionless, decentralized token swaps without order books or centralized custody. With approximately $10 billion in TVL and billions in daily trading volume, Uniswap stands as the leading decentralized exchange.

The protocol’s version 4 (v4) rollout introduces customizable liquidity pools (hooks), dynamic fees, and enhanced capital efficiency, strengthening its competitive position against both centralized exchanges and rival DEXs. As more users prioritize self-custody and censorship resistance, DEX adoption continues accelerating.

UNI token holders govern protocol development and fee structures, potentially benefiting from value accrual mechanisms as the protocol matures. With DeFi trading volume steadily increasing and Layer 2 integrations reducing transaction costs, Uniswap represents a cornerstone investment in decentralized exchange infrastructure.

Emerging DeFi Opportunities

Beyond established protocols, several newer DeFi projects show exceptional promise. Ethena (ENA) offers synthetic stablecoins backed by Ethereum and perpetual futures, providing yield-generating dollar-pegged assets. Curve Finance (CRV) specializes in efficient stablecoin swaps with low slippage, critical infrastructure as stablecoin usage expands. Chainlink (LINK) provides oracle services that bring real-world data onto blockchains, essential for DeFi protocols, RWA tokenization, and smart contract functionality.

The DeFi sector has rebounded strongly in 2025 after a period of consolidation, with protocols implementing community-first models, sustainable tokenomics, and innovative revenue-sharing mechanisms. Projects like Blackhole DEX have demonstrated how effective token design can create powerful growth flywheels, attracting billions in TVL within days.

High-Potential Altcoins for Explosive Growth

Solana (SOL): The High-Performance Blockchain

Solana has become Ethereum’s top competitor, offering up to 65,000 TPS and sub-cent fees. It has a market cap over $105 billion, trading at $193–$206. Major upgrades like Firedancer boost reliability, while Solana Pay integrates with Shopify for retail use. Solana gained 5.3% in one day on October 15, 2025, outpacing most cryptocurrencies. With a 90% chance of Solana Spot ETF approval, institutional inflows could drive further growth.

The network’s technical advantages make it particularly attractive for consumer-facing applications, NFT marketplaces, DeFi protocols, and DePIN (Decentralized Physical Infrastructure Networks). Major developments include the introduction of Firedancer, a high-performance validator client that dramatically boosts network reliability, and Solana Pay gaining traction for retail payments through Shopify integration.

Solana experienced a remarkable 5.3% gain in a single day as of October 15, 2025, leading major cryptocurrencies in short-term performance. Bloomberg Intelligence analysts cite a 90% probability that Solana Spot ETFs will receive approval in 2025, which could channel substantial institutional capital into SOL. The combination of technical excellence, growing developer activity, and potential ETF approval positions Solana as a high-conviction altcoin investment.

XRP (Ripple): Cross-Border Payment Specialist

After years of regulatory uncertainty, XRP has emerged as one of 2025’s top performers, with year-to-date gains exceeding 380% as of July. Trading around $2.40-$2.62 with a market capitalization of approximately $144-$157 billion, XRP focuses on fast, low-cost cross-border payments.

Ripple’s RippleNet continues expanding partnerships with global banks and financial institutions, providing real-world utility for XRP. The XRP Ledger processes transactions in 3-5 seconds with minimal fees, positioning it as infrastructure for international remittances and institutional payments. While XRP may not inspire the same excitement as DeFi protocols or meme coins, its distinct use case, institutional traction, and potential Ripple ETF consideration make it a steady-growth investment opportunity.

Cardano (ADA): The Research-Driven Platform

Cardano distinguishes itself through rigorous peer-reviewed development and a focus on sustainability, scalability, and interoperability. With a market capitalization around $24-$35 billion and trading at $0.67-$0.99, Cardano offers accessible entry points for investors.

The platform’s staking mechanism provides approximately 4.96% APY with minimal barriers to entry (just 2 ADA plus a refundable fee), making it attractive for passive income seekers. Cardano’s methodical approach prioritizes long-term viability over rapid deployment, appealing to investors seeking projects with strong fundamentals and academic rigor.

Avalanche (AVAX): Speed Meets Eco-Friendliness

Avalanche combines high-speed transaction processing with environmental sustainability, offering 8-10% staking APY and fast finalization times. With a market capitalization around $9-$12 billion and trading at $20-$23, AVAX provides exposure to a platform competing in smart contracts, DeFi, and enterprise blockchain solutions.

The platform’s subnet architecture allows customizable blockchains tailored to specific use cases, attracting enterprise adoption and specialized applications. Avalanche’s strong technological advantages and growing ecosystem position it as a compelling mid-cap altcoin investment.

Polkadot (DOT): The Interoperability Solution

Polkadot addresses one of blockchain’s most pressing challenges: interoperability between different networks. The platform enables seamless data and asset transfers across blockchains, with governance council members including Google, IBM, and Boeing.

Trading around $3.33-$5.40 billion market cap, Polkadot offers exposure to the cross-chain future of blockchain technology. Its parachain auction model and strong developer community suggest significant growth potential as blockchain interoperability becomes increasingly critical.

Layer 2 Solutions: Scaling the Future

Layer 2 (L2) solutions address blockchain scalability by enabling thousands of transactions per second at much lower costs. They also maintain the security of underlying Layer 1 networks. For investors seeking the best cryptocurrencies to buy for profit, L2 tokens provide exposure to technology solving Ethereum’s key challenges.

Polygon (MATIC): Multi-Chain Ecosystem

Polygon has become the leading Ethereum scaling solution. It offers multiple Layer 2 technologies such as sidechains, plasma chains, and zero-knowledge rollups. The platform handles millions of daily transactions at a fraction of Ethereum mainnet costs. It also hosts major DeFi protocols, NFT platforms, and enterprise applications.

With partnerships spanning Disney, Starbucks, Nike, and numerous blockchain projects, Polygon demonstrates real-world adoption at scale. The platform’s evolution toward a multi-chain ecosystem connecting various L2 solutions positions it as critical infrastructure for Ethereum’s scaling roadmap.

Arbitrum (ARB): Optimistic Rollup Leader

Arbitrum ranks among the most successful Ethereum L2 solutions. Specifically, it utilizes optimistic rollup technology to achieve high throughput with low fees, all while maintaining Ethereum’s robust security guarantees. Moreover, the platform has attracted billions in total value locked and, consequently, hosts thriving DeFi ecosystems, including major DEXs, lending protocols, and innovative applications.

Arbitrum’s developer-friendly approach and EVM (Ethereum Virtual Machine) compatibility enable seamless migration of Ethereum applications, accelerating adoption. As Ethereum gas fees remain a barrier to mainstream adoption, Arbitrum’s scaling solution becomes increasingly valuable.

Optimism (OP): Community-Driven Scaling

Optimism employs optimistic rollup technology similar to Arbitrum but differentiates through its focus on public goods funding and community governance. The OP token provides governance rights and potentially benefits from value accrual as the network grows.

Optimism’s retroactive public goods funding model directs protocol revenue toward developers and projects contributing to the ecosystem, creating sustainable long-term incentives. This approach attracts mission-driven developers and establishes Optimism as more than just scaling infrastructure.

Immutable X (IMX): Gaming and NFT Specialist

Immutable X provides zero-gas-fee NFT transactions and trading, specifically optimized for gaming and digital collectibles. With a market cap around $1.45 billion and trading approximately $0.85, IMX targets the massive gaming and NFT markets.

The platform’s partnerships with major gaming studios and the launch of Immutable zkEVM expand its capabilities. As Web3 gaming and NFT adoption accelerate, Immutable X’s specialized focus positions it for substantial growth.

Meme Coins: High-Risk, High-Reward Opportunities

Meme coins represent the cryptocurrency market’s most speculative sector, combining viral marketing, community enthusiasm, and extreme volatility to create opportunities for extraordinary gains—and equally extraordinary losses. While lacking inherent utility, meme coins have proven capable of delivering life-changing returns for early investors.

Dogecoin (DOGE): The Original Meme King

Dogecoin pioneered the meme coin category and maintains a market capitalization around $30-$31 billion despite originating as a joke. The cryptocurrency benefits from widespread recognition, celebrity endorsements (particularly from Elon Musk), and a loyal community that has sustained it through multiple market cycles.

While DOGE’s massive supply creates upside limitations compared to smaller meme coins, its established position and potential for renewed hype during bull markets make it the “safest” meme coin investment. Speculation about potential DOGE ETF approval, though uncertain, could trigger significant price movements.

Shiba Inu (SHIB): The Ecosystem Builder

Shiba Inu evolved from a simple Dogecoin competitor into a broader ecosystem including ShibaSwap DEX, the Shibarium Layer 2 network, and NFT collections. With a market cap around $6-$7 billion, SHIB demonstrates how meme coins can add utility beyond speculation.

The Shibarium L2 provides infrastructure for low-cost transactions and DApp development within the Shiba ecosystem, potentially driving demand for SHIB tokens. This evolution toward utility while maintaining meme appeal creates a unique investment proposition.

Emerging Meme Coin Opportunities

New meme coins continue launching with innovative features and massive upside potential. Projects like BullZilla, currently raising funds in presale, offer stage-based pricing with projected 3,000%+ returns from early stages to listing prices. Solaxy combines meme culture with Layer 2 technology on Solana, offering technical foundations alongside community appeal.

Dogwifhat (WIF) and Bonk represent Solana-based meme coins that have delivered substantial returns, demonstrating that meme coin success isn’t limited to Ethereum. These projects benefit from Solana’s low fees and fast transactions, enabling more active trading and community engagement.

Meme Coin Investment Considerations

Investing in meme coins requires accepting extreme volatility and the reality that most projects fail. However, for those allocating small portions of their portfolio to speculative plays, meme coins offer asymmetric upside potential. Key factors for evaluating meme coins include:

Community Strength: Active, engaged communities drive sustained interest and price support. Projects with organic growth and authentic enthusiasm outperform those relying solely on paid marketing.

Tokenomics: Supply dynamics, burn mechanisms, and distribution models significantly impact long-term viability. Projects implementing deflationary tokenomics or rewards for holders demonstrate more sustainability.

Narrative and Timing: Meme coins excel during bull markets when risk appetite increases. Understanding market cycles and entering during accumulation phases rather than euphoric peaks improves success probability.

Utility Addition: Meme coins evolving beyond pure speculation by integrating staking, NFTs, gaming, or real utility tend to sustain interest longer than those based solely on hype.

Never invest more than you can afford to lose entirely in meme coins. These assets should represent only a small, speculative portion of a diversified cryptocurrency portfolio.

Emerging Categories: AI, RWA, and Cross-Chain

AI-Integrated Cryptocurrencies

Artificial intelligence integration represents one of 2025’s hottest cryptocurrency narratives, with projects combining blockchain and AI technologies attracting significant investment. AI tokens enable decentralized machine learning, data marketplaces, and automated trading systems.

Projects like Sahara AI and Moby AI demonstrate how AI-powered analytics, prediction models, and autonomous agents can enhance cryptocurrency trading and DeFi strategies. As AI continues revolutionizing technology sectors, blockchain-AI convergence offers early-stage investment opportunities with substantial growth potential.

Real-World Asset (RWA) Tokenization

RWA tokenization brings traditional financial products—U.S. Treasury bills, real estate, commodities, invoices—onto blockchain infrastructure, bridging TradFi and DeFi. This sector provides cryptocurrency investors access to predictable yields from traditional assets while maintaining blockchain benefits like 24/7 trading, fractional ownership, and transparent settlement.

Protocols specializing in RWA tokenization are attracting institutional interest as they provide familiar assets in innovative formats. This category represents a lower-volatility option for cryptocurrency portfolios while participating in blockchain’s transformative potential.

Cross-Chain and Interoperability Solutions

As the multi-chain future materializes, cross-chain protocols enabling seamless asset transfers and unified liquidity become increasingly valuable. Projects like Synapse, Stargate, and Wormhole facilitate moving assets between Ethereum, Solana, Avalanche, BNB Chain, and other networks.

These protocols address critical user experience challenges and unlock composability across ecosystems. As blockchain fragmentation increases, interoperability solutions capture growing value from cross-chain activity.

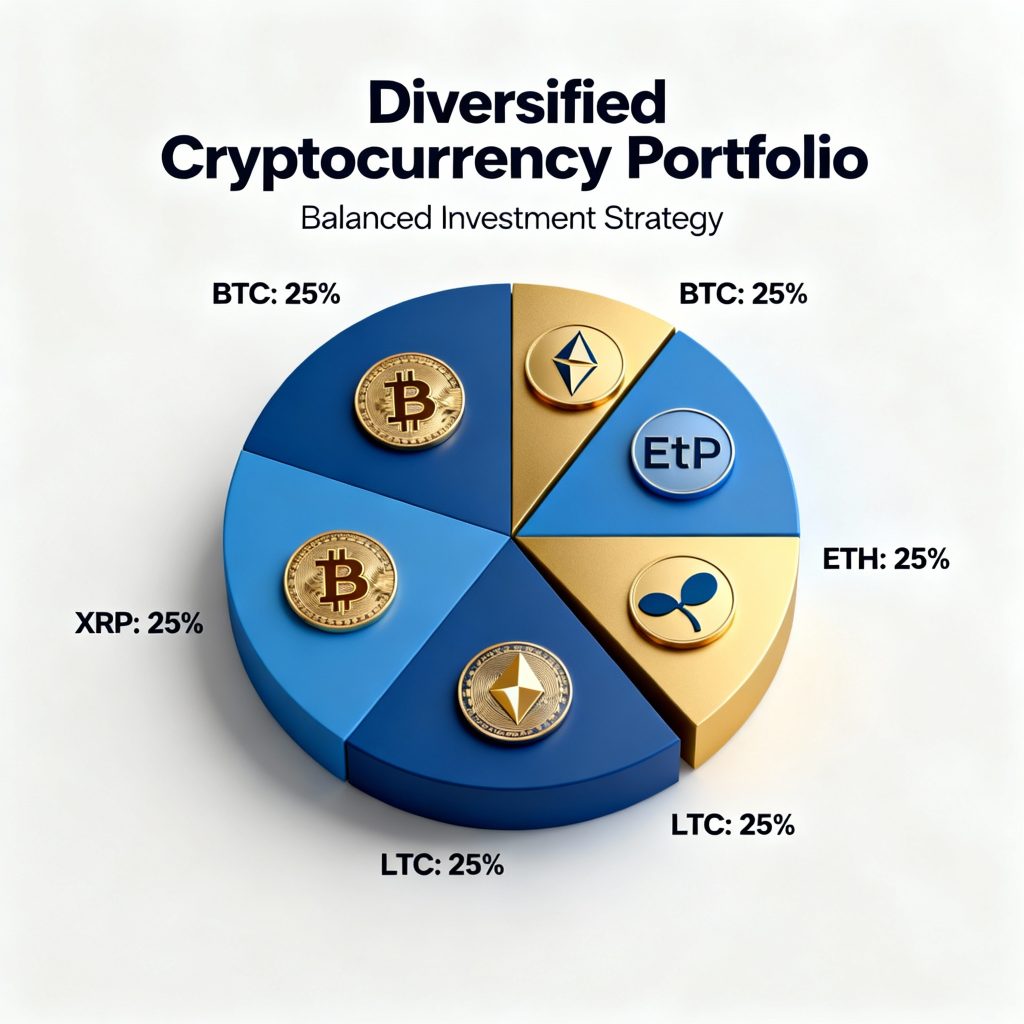

Building Your Profitable Cryptocurrency Portfolio

Constructing a cryptocurrency portfolio optimized for profit requires balancing multiple considerations: risk tolerance, time horizon, market understanding, and diversification across asset categories.

Core Holdings: Stability Foundation

Allocate 40-60% of your cryptocurrency portfolio to Bitcoin and Ethereum. These established assets provide relative stability, substantial liquidity, and exposure to the market’s overall growth. Their institutional adoption and regulatory clarity reduce risk compared to smaller altcoins.

Growth Allocations: High-Potential Altcoins

Dedicate 25-40% to promising altcoins with strong fundamentals, including:

- DeFi protocols like Aave, Uniswap, or Lido for exposure to decentralized finance growth

- Layer 2 solutions like Polygon, Arbitrum, or Optimism for scaling infrastructure

- Smart contract platforms like Solana, Cardano, or Avalanche for ecosystem diversity

- Sector-specific leaders like Chainlink (oracles), The Graph (indexing), or Immutable X (gaming)

Speculative Plays: Asymmetric Upside

Reserve 10-20% for speculative investments including:

- Emerging meme coins during early presale stages

- Low-cap altcoins with innovative technology or strong communities

- New narratives like AI-crypto integration or RWA tokenization

Risk Management Principles

Dollar-Cost Averaging (DCA): Rather than investing lump sums, spread purchases over time to average entry prices and reduce timing risk.

Portfolio Rebalancing: Periodically adjust holdings to maintain target allocations, taking profits from outperformers and adding to underperformers.

Secure Storage: Use hardware wallets for long-term holdings, maintaining only trading amounts on exchanges.

Continuous Learning: Stay informed about technological developments, regulatory changes, and market dynamics affecting your investments.

Avoiding Common Mistakes

Don’t chase pumps—entering positions during euphoric rallies often leads to buying tops. Resist FOMO (Fear of Missing Out) and stick to your investment thesis. Avoid overconcentration in any single asset, regardless of conviction. Never invest borrowed money or funds needed for living expenses.

Research thoroughly before investing. Understand the project’s purpose, team, technology, tokenomics, and competitive positioning. Verify information from multiple sources rather than relying on social media hype or influencer promotions.

Market Analysis: What Drives Cryptocurrency Profits

Understanding what drives cryptocurrency price appreciation helps identify the best cryptocurrencies to buy for profit. Multiple factors influence valuations:

Supply and Demand Dynamics: Fixed or decreasing supply (through burns or halvings) combined with increasing demand creates upward price pressure. Bitcoin’s 21 million supply cap exemplifies this principle.

Adoption and Utility: Cryptocurrencies solving real problems and gaining users appreciate as network effects strengthen. Ethereum’s position hosting DeFi, NFTs, and tokenization demonstrates utility-driven value.

Technological Innovation: Platforms introducing breakthrough solutions to scalability, interoperability, or user experience attract developers and users, driving token value.

Institutional Investment: Mainstream financial institutions allocating capital to cryptocurrency validates the asset class and provides substantial buying pressure.

Regulatory Developments: Clear, favorable regulations reduce uncertainty and enable broader adoption, while restrictive policies can suppress prices.

Market Sentiment: Cryptocurrency remains influenced by social media trends, celebrity endorsements, and community enthusiasm, particularly for smaller assets.

Macroeconomic Factors: Interest rates, inflation expectations, currency debasement, and risk appetite affect cryptocurrency as an alternative asset class.

Timing Considerations for 2025

Current market conditions suggest favorable opportunities for strategic cryptocurrency investment. The total market capitalization approaching $4 trillion reflects sustained interest despite volatility. Several catalysts could drive substantial appreciation:

Altseason Potential: Bitcoin dominance around 65% historically precedes significant altcoin rallies as capital rotates into higher-beta assets. If dominance declines to 50-54%, altcoins could experience explosive growth.

ETF Approvals: Beyond Bitcoin and Ethereum ETFs, potential approvals for Solana, XRP, Dogecoin, and other altcoin ETFs could channel billions in new capital.

Institutional FOMO: As cryptocurrency investment normalizes, more traditional investors and corporations may allocate portions of portfolios to digital assets.

Technological Maturation: Layer 2 solutions, improved user experiences, and enhanced security are addressing barriers to mainstream adoption.

Global Economic Uncertainty: Ongoing geopolitical tensions, currency instability, and inflation concerns drive interest in non-correlated alternative assets.

However, investors should acknowledge risks including continued volatility, potential regulatory challenges, macroeconomic headwinds, and the reality that not all cryptocurrencies will succeed.

Conclusion: Your Pathway to Cryptocurrency Profits

Identifying the best cryptocurrencies to buy for profit in 2025 means balancing stability and growth. You need core assets like Bitcoin and Ethereum for portfolio foundation. Then, add high-potential opportunities in DeFi tokens (Lido, Aave, Uniswap), Layer 2 solutions (Polygon, Arbitrum), and leading altcoins (Solana, XRP, Cardano). Finally, allocate a small portion to speculative plays such as select meme coins for asymmetric upside.

Successful crypto investing demands more than project selection. It also requires strict risk management, ongoing education, secure storage, and emotional discipline. Top investors conduct thorough research, diversify wisely, avoid impulsive FOMO or panic trades, and focus on long-term goals despite short-term swings.

Cryptocurrency has evolved rapidly from a speculative experiment into a recognized asset class. With advancing technology, wider adoption, and growing institutional support, 2025 offers major opportunities. By choosing assets strategically, managing risks carefully, and exercising patience, you can position your portfolio to benefit from this ongoing financial revolution.

The future belongs to investors who view cryptocurrency as more than a trading vehicle. It is a transformative technology reshaping money and ownership. Whether you aim to build wealth, earn passive income, or capture explosive growth, the right crypto investments in 2025 can help you achieve those goals. The key question is not “if” to invest, but “how” to invest strategically for success.