Understanding the Wealth Mindset: Why Traditional Budgeting Fails

Most people approach money backwards. They pay bills first, spend on wants second, and save whatever’s left over (which is usually nothing). This reactive approach keeps 99% of people trapped in a cycle where they never build meaningful wealth.

The wealthy do something fundamentally different: they assign a specific purpose to every dollar before they spend it. This isn’t just budgeting—it’s strategic money allocation that prioritizes wealth building over immediate gratification.

High-net-worth individuals typically spend only one-third of their post-tax income and save the remaining two-thirds. This aggressive savings rate isn’t possible overnight, but it demonstrates the mindset shift required for true financial freedom.

The 25-15-50-10 Rule Breakdown

The 25-15-50-10 rule divides your after-tax income into four strategic categories:

- 25% for Growth – Investments that increase in value over time

- 15% for Stability – Emergency fund and financial safety net

- 50% for Essentials – True necessities for survival and function

- 10% for Rewards – Guilt-free spending on enjoyment and experiences

This allocation ensures you’re simultaneously building wealth, protecting your progress, meeting your needs, and maintaining quality of life.

25% for Growth: Make Your Money Work for You

The first and most crucial allocation is 25% toward growth assets—investments that appreciate in value and generate passive income while you sleep. This percentage separates wealth builders from everyone else.

Why Growth Investments Matter

Traditional thinking suggests saving money in bank accounts, but wealthy individuals understand that inflation erodes the purchasing power of cash over time. Money sitting in low-interest savings accounts actually loses value annually.

Growth investments combat inflation while building long-term wealth. The key is consistency rather than perfect timing. Research shows that someone who starts investing $200 monthly at age 20 will have $1,264,816 by age 60, while someone who starts at 30 with $300 monthly will only have $678,146—despite investing $12,000 less, the early starter ends up with nearly $600,000 more due to compound interest.

Growth Investment Options by Risk Level

Low Risk – High Consistency:

- Index Funds: Broad market exposure through funds like the S&P 500, which has averaged 10% annual returns over the past 100 years

- Real Estate Investment Trusts (REITs): Real estate exposure without direct property ownership

- Government Bonds: Lower returns but maximum stability

Medium Risk – Higher Potential Returns:

- High-Income Skills: Learning copywriting, coding, sales, or digital marketing provides the fastest return on investment since no one can take these abilities away from you

- Real Estate: Rental properties or house-hacking strategies for younger investors

Higher Risk – Maximum Growth Potential:

- Individual Stocks: Requires research and expertise; treat as hobby money initially

- Online Businesses: E-commerce, digital products, or service-based ventures

- Alternative Investments: Cryptocurrency (limit to 5-10% of portfolio), precious metals, or collectibles

Setting Up Tax-Advantaged Accounts

Before investing, optimize your tax strategy through specific account types:

United States:

- Roth IRA: $7,000 annual limit (2025), tax-free growth and withdrawals in retirement

- 401(k): Pre-tax contributions with employer matching (free money)

- Traditional IRA: Tax deductions now, taxed later

United Kingdom:

- Stocks & Shares ISA: £20,000 annual limit, completely tax-free growth

- Workplace Pension: Employer matching contributions

Other Countries: Research local tax-advantaged investment accounts in your region.

The Three-Fund Portfolio Strategy

For beginners, a simple three-fund portfolio provides excellent diversification:

- 60% US Stock Index Fund (S&P 500 or Total Stock Market)

- 30% International Stock Index Fund (Global markets outside your home country)

- 10% Bond Fund (Government or corporate bonds for stability)

Automate monthly contributions to remove emotion from investing. The wealthy understand that consistent investing beats perfect timing every time.

15% for Stability: Your Financial Safety Net

Financial stability isn’t about having money—it’s about having breathing room when life happens unexpectedly. Most people don’t have a money problem; they have a stability problem. One car repair or medical bill forces them into debt, setting back their financial progress for months or years.

Calculating Your Stability Fund

Your stability fund should cover 5 months of essential expenses (more conservative than the typical 3-month recommendation). Here’s the calculation process:

- List Core Expenses: Rent/mortgage, utilities, groceries, transportation, insurance, minimum debt payments

- Calculate Monthly Baseline: Add up all essential costs

- Multiply by 5: This creates your target emergency fund

- Allocate 15% monthly: Direct 15% of income toward building this fund

Example: If monthly essentials total $2,000, your stability fund target is $10,000. At $4,000 monthly income, allocate $600 (15%) toward building this fund.

Where to Store Your Emergency Fund

Your stability fund must meet three non-negotiable criteria:

Easy Access: Available within 24 hours maximum—no penalties or waiting periods

Zero Risk: FDIC-insured accounts only; never invest emergency funds

Always Earning: High-yield savings accounts currently offer 4-5% APY, far better than traditional savings accounts at 0.01-0.05%

Recommended High-Yield Savings Options (as of September 2025):

- SoFi Bank: Up to 4.50% APY

- Axos ONE Savings: 4.46% APY

- Western Alliance Bank: 4.30% APY

- Marcus by Goldman Sachs: 3.65% APY

- American Express: 3.50% APY

Building Your Stability Fund Faster

Three tactics accelerate emergency fund building:

Paycheck Sweep: Automatically transfer 15% of every paycheck directly to your emergency fund before you can spend it

Replacement Promise: If you use emergency funds, immediately replace the amount with your next paycheck—no exceptions

Save by Spending: Use roundup apps that save spare change from purchases, plus redirect all cashback rewards to your emergency fund

Once fully funded, redirect this 15% toward additional growth investments or the rewards category.

50% for Essentials: Feed Your Life, Not Your Ego

The 50% allocation for essentials forces you to distinguish between true needs and lifestyle inflation. While the average American spends 60-70% of income on perceived necessities, limiting essentials to 50% creates space for wealth building while meeting all genuine needs.

Defining True Essentials

Genuine Necessities Include:

- Housing (rent/mortgage, utilities)

- Transportation (car payment, gas, insurance, maintenance)

- Food (groceries, not restaurant meals)

- Healthcare and insurance

- Minimum debt payments

- Basic clothing for work and weather

Not Essential:

- Streaming services beyond one primary option

- Gym memberships you don’t use

- Takeout and restaurant meals

- Designer clothing or accessories

- Impulse purchases

- Subscription boxes or services

Optimizing Your Two Biggest Expenses

Housing optimization offers the greatest impact since it typically represents the largest expense:

- Negotiate rent renewals: Most landlords prefer keeping tenants over finding new ones

- Consider house hacking: Rent out spare rooms or live in multi-unit properties

- Location flexibility: Living further from city centers often provides significant savings

- Refinance mortgages: Take advantage of lower interest rates when available

Transportation optimization provides the second-biggest opportunity:

- Buy reliable used vehicles: Avoid depreciation and high payments on new cars

- Consider car-free living: In walkable areas, eliminating car ownership saves hundreds monthly

- Optimize insurance: Shop rates annually and adjust coverage as needed

- Maintain vehicles properly: Preventive maintenance prevents expensive repairs

The Decision Framework for Purchases

Before any non-essential purchase, ask these questions:

- Is this an impulse purchase? If yes, wait 7 days before deciding

- Am I buying for brand or value? Choose quality over marketing

- Will this genuinely improve my life? Avoid purchases made for status or boredom

This framework prevents lifestyle creep while ensuring you invest in items that provide real value and utility.

10% for Rewards: Staying Sane While Building Wealth

The 10% rewards allocation prevents the deprivation mindset that destroys long-term financial plans. Research shows that 92% of people overspend after intensive saving periods because saving without enjoyment feels like punishment.

Strategic Reward Spending

High-Value Reward Categories:

Experiences and Travel: $12,254 average annual vacation spending among high-net-worth individuals, creating lasting memories and stress relief

Social Connections: Dinners with friends, concerts, and entertainment that strengthen relationships—wealthy individuals understand that networks create opportunities

Hobbies and Skills: Activities that provide fulfillment and potentially generate future income

Gifts for Others: Strengthening relationships through thoughtful giving enhances personal and professional networks

The Joy Jar System

Create a separate “joy jar” account for your 10% rewards allocation:

- Automatic Transfer: 10% of every paycheck goes directly to this account

- No Borrowing: Never supplement from other categories when the account is empty

- Wait Until Next Month: Scarcity creates intentional spending decisions

- Prioritize Experiences: Memories provide more lasting satisfaction than material possessions

This system protects your growth, stability, and essential allocations while ensuring you enjoy the journey toward financial freedom.

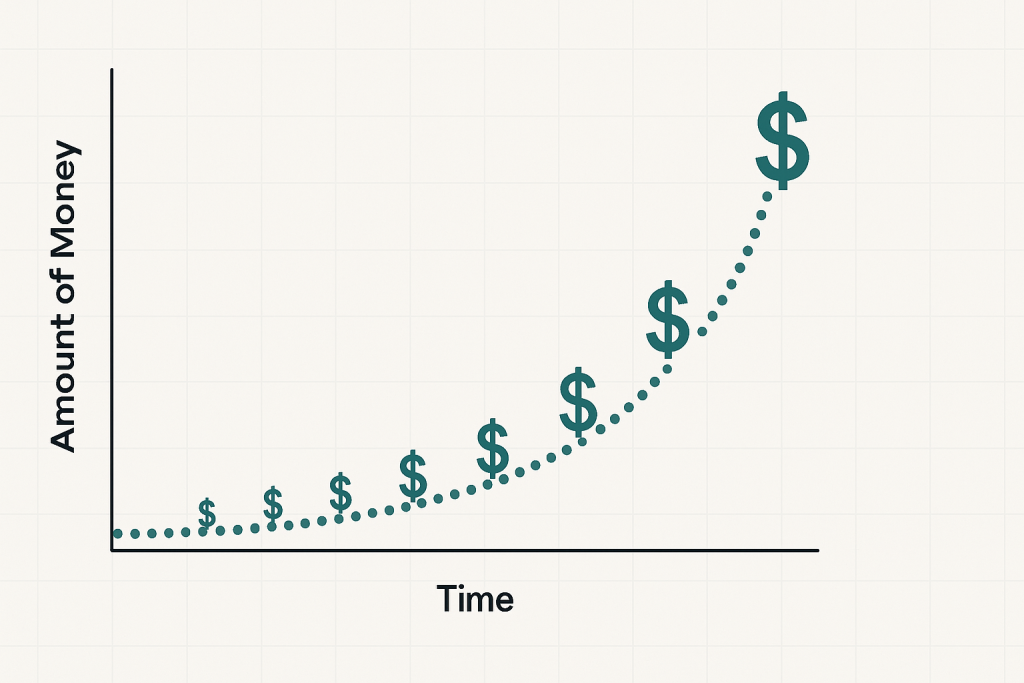

The Power of Compound Interest: Time is Your Greatest Asset

Understanding compound interest reveals why starting early matters more than starting with large amounts. This mathematical principle drives wealth creation over time and separates those who build lasting prosperity from those who remain financially stagnant.

Compound Interest in Action

Real-world example: $10,000 invested at 5% annual interest becomes:

- Year 1: $10,500 ($500 interest)

- Year 5: $12,763 ($2,763 total interest)

- Year 10: $16,289 ($6,289 total interest)

- Year 20: $26,533 ($16,533 total interest)

The interest earned in year 20 alone ($1,327) exceeds the total interest from the first two years combined. This accelerating growth makes time your most valuable asset.

Starting Early vs. Starting Late

Billy starts investing $200/month at age 20 for 40 years:

- Total invested: $96,000

- Final value at 10% annual return: $1,264,816

Phil starts investing $300/month at age 30 for 30 years:

- Total invested: $108,000

- Final value at 10% annual return: $678,146

Despite investing $12,000 less, Billy ends up with $586,670 more simply by starting 10 years earlier. This demonstrates why the 25% growth allocation should begin immediately, regardless of the amount.

Maximizing Compound Growth

Frequency of compounding affects total returns:

- Annual compounding: $1,000 at 5% becomes $1,629 over 10 years

- Monthly compounding: Same investment becomes $1,647

- Daily compounding: Reaches $1,649

While the differences seem small, they become significant over longer periods and larger amounts.

Common Mistakes to Avoid

Perfectionism Paralysis: Starting with small amounts beats waiting for “enough” money to begin. Consistency matters more than size.

Emotional Investing: Avoid panic selling during market downturns or chasing hot investment trends. Stick to your systematic approach.

Lifestyle Inflation: As income increases, maintain percentage allocations rather than increasing spending proportionally. Scale your wealth building, not your expenses.

Emergency Fund Confusion: Never invest emergency funds in volatile assets. Safety and accessibility trump returns for this category.

Neglecting Tax Optimization: Failing to use tax-advantaged accounts costs thousands in unnecessary taxes over time. Maximize these benefits first.

Adapting the Rule to Your Income Level

Lower Income ($30,000-$50,000)

- Focus heavily on high-income skill development

- Start with index funds requiring minimal initial investment

- Consider house hacking or living with roommates

- Use every tax advantage available (earned income credit, etc.)

Middle Income ($50,000-$100,000)

- Aggressively build emergency fund first

- Maximize employer 401(k) matching

- Begin real estate research for future investment

- Increase income through skills and side businesses

Higher Income ($100,000+)

- Consider real estate investment for diversification

- Explore business ownership opportunities

- Implement advanced tax strategies

- Build multiple income streams for financial independence

The Psychological Aspect of Wealth Building

Wealthy individuals think differently about money. They view dollars as tools for creating more wealth rather than for immediate consumption. This mindset shift is crucial for long-term success.

Key mental shifts required:

- Delayed gratification becomes easier when you see money growing

- Opportunity cost thinking helps evaluate every purchase decision

- Long-term perspective reduces anxiety about short-term market fluctuations

- Systems over willpower create sustainable financial habits

Why This System Works When Others Fail

The 25-15-50-10 rule succeeds because it balances all aspects of financial health simultaneously. Unlike extreme approaches that focus solely on saving or investing, this system:

- Builds wealth through consistent growth investing

- Provides security via emergency fund stability

- Meets needs without deprivation or lifestyle punishment

- Maintains motivation through guilt-free reward spending

- Creates systems that work regardless of willpower fluctuations

Measuring Your Progress

Track these metrics monthly:

- Growth account balance and monthly contributions

- Emergency fund progress toward 5-month target

- Essential expense ratio as percentage of income

- Net worth growth across all categories

Celebrate milestones:

- First $1,000 in growth investments

- Fully funded emergency fund

- First $10,000 net worth

- Monthly passive income milestones

Starting Today: Your Action Plan

This week:

- Calculate your monthly essential expenses

- Open a high-yield savings account

- Set up automatic transfers for all four categories

- Research low-cost index funds available to you

This month:

- Make your first growth investment

- Optimize your two largest expenses

- Begin building your emergency fund

- Create your joy jar reward account

This year:

- Fully fund your 5-month emergency fund

- Consistently invest 25% in growth assets

- Develop high-income skills for increased earning power

- Build systems that make good money decisions automatic

The Long-Term Vision

The 25-15-50-10 rule isn’t about immediate gratification—it’s about creating the financial foundation for true freedom. While others remain trapped in paycheck-to-paycheck cycles, you’ll be systematically building wealth that works for you.

Within 5-10 years of consistent implementation, most people following this system experience:

- Substantial emergency funds providing complete peace of mind

- Growing investment portfolios generating meaningful passive income

- Optimized lifestyles focused on value rather than status

- Increased earning power through skill development and networking

The wealthy understand that money management, not just money earning, creates lasting prosperity. By implementing the 25-15-50-10 rule today, you’re adopting the same strategic approach that separates the financially free from everyone else.

Your future self will thank you for starting now, regardless of your current income level. The key is beginning the system, maintaining consistency, and allowing compound interest to work its magic over time.